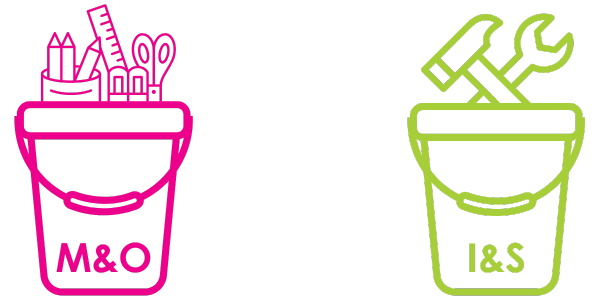

Breaking down the budget into two buckets

-

School district tax rates are made up of two parts: Maintenance & Operations or M&O and Interest & Sinking or I&S. The M&O tax rate is added to the I&S tax rate to create a district’s overall school tax rate. The total school taxes due equals the total school tax rate multiplied by the assessed value of the property then divided by 100.

M&O tax collections help pay for expenses like salaries, supplies, utilities and other daily operating costs. I&S tax collections may only be used to pay down debt for school improvements, construction and interest incurred when voters approve a school bond election.

Money approved by local voters in bond elections cannot be used to pay for daily expenses like salaries, benefits and utilities

-

Growth causes property values to rise, but under the current funding formula, Denton ISD does not receive more money.

Many assume new home construction and rising property values boost school funding – but that is definitely not the case. Under the current funding formula established by the state of Texas, as property values increase, state funding decreases.

The only way to increase the amount of money a district receives is through strong attendance, since Texas is one of only six states in the country that funds schools based on attendance rather than enrollment.