Bond History

Page Navigation

Tax Information

-

NO TAX RATE INCREASE

The Denton ISD tax rate will not increase as a result of the May 5, 2018 election.

If the bond referendum is approved by voters, the school board has said the district tax rate will remain the same. The overall tax rate has been $1.54 since 2014-2015 and it is the intent of the school board and administration to maintain the total rate at $1.54 regardless of the election results.

ABOUT PUBLIC SCHOOL TAX RATES

Public school taxes involve two figures, which divide the school district budget into two “buckets.”

The first bucket is the Maintenance and Operations budget (M&O), which funds daily costs and recurring or consumable expenditures such as teacher and staff salaries, supplies, utilities, etc. Approximately 82 percent of the district’s M&O budget goes to teacher and staff salaries.

The second bucket is the Interest and Sinking budget (I&S), also known as Debt Service, and that is used to repay debt for longer-term capital improvements approved by voters through bond elections. Proceeds from a bond issue can be used for the construction and renovation of facilities, the acquisition of land and the purchase of capital items such as equipment, technology and transportation. I&S funds cannot by law be used to pay M&O expenses, which means that voter-approved bonds cannot be used to increase teacher salaries or pay rising costs for utilities and services.DENTON ISD TAX RATE

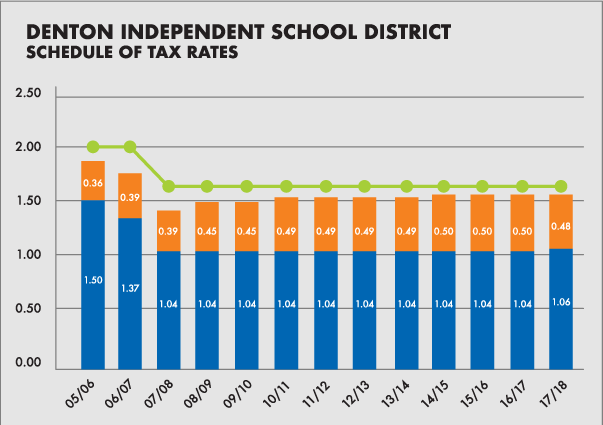

Denton ISD’s I&S tax rate is $0.48 and the M&O tax rate is $1.06 for a total tax rate of $1.54 per $100 of certified property value.

TAX RATE HISTORY

The chart below shows the district’s tax rate over the past 10 years.

SENIOR CITIZENS’ PROPERTY TAXES

Citizens age 65 or older can apply for a homestead exemption with the Denton Central Appraisal District.

According to state law, the dollar amount of school taxes imposed on the residence homestead of a person 65 years of age or older cannot be increased above the amount paid in the first year after the person turned 65 – regardless of changes in tax rate or property value – unless significant improvements are made to the home.

For more information on the over-65 exemption, visit the Denton Central Appraisal District website.

The May 5, 2018 bond election in Denton ISD will have no impact on the school district tax rate. The overall tax rate will be $1.54 regardless of the election outcome.

*BOND ELECTION VS. TAX RATIFICATION ELECTION

Revenue from Bond Elections add funds to the District’s Interest & Sinking (I&S) budget, which is used to repay debt for capital improvements. I&S funds cannot by law be used to pay M&O expenses, which means that voter-approved bonds cannot be used to increase teacher salaries or pay rising costs for utilities and services. Revenue from the Tax Ratification Election (TRE), which Denton ISD voters approved in September 2017, will add approximately $7.9 million annually to the Maintenance & Operations (M&O) budget. M&O funds are used for daily costs like teacher and staff salaries, supplies, food and utilities.