About Proposition A

1925 Advisory Committee

-

Made up of parents, staff, and community members, the 1925 Advisory Committee studied Denton ISD’s financial outlook, staffing formulas, and program funding needs for the 2025–26 budget. On June 10, 2025, the committee recommended that the Board of Trustees call for a Voter Approval Tax Rate Election.

At its August 12 meeting, the Denton ISD Board of Trustees unanimously approved placing Proposition A, also known as a Tax Ratification Election (TRE), on the November 4, 2025, election ballot.

1925 Advisory Committee

-

IMPORTANT VOTING DEADLINES

Voter Registration Deadline: October 6, 2025

Early Voting Period: October 20-31, 2025

Election Date: November 4, 2025

Find more information visit the Denton ISD Voting Information Website.

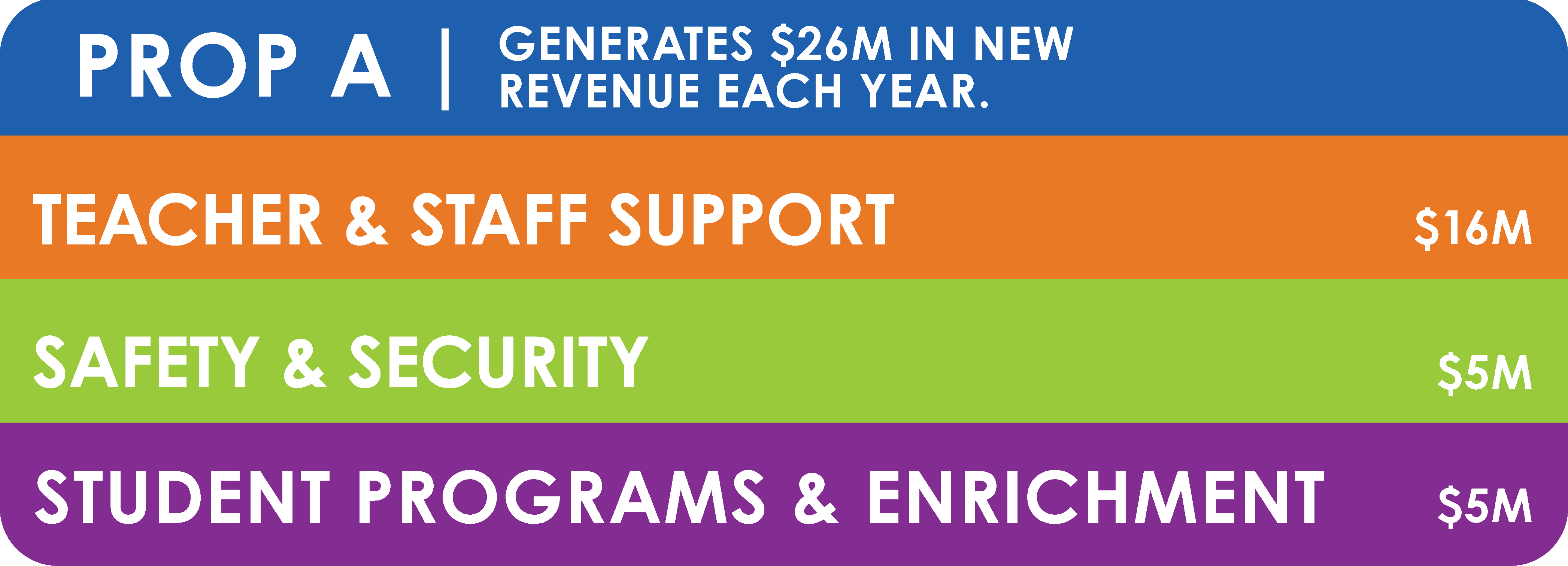

Teacher & Staff Support

Safety & Security

Student Programs & Enrichment

-

If voter approved on November 4, Proposition A would provide additional state and local revenue for the following Board-approved operational categories.

-

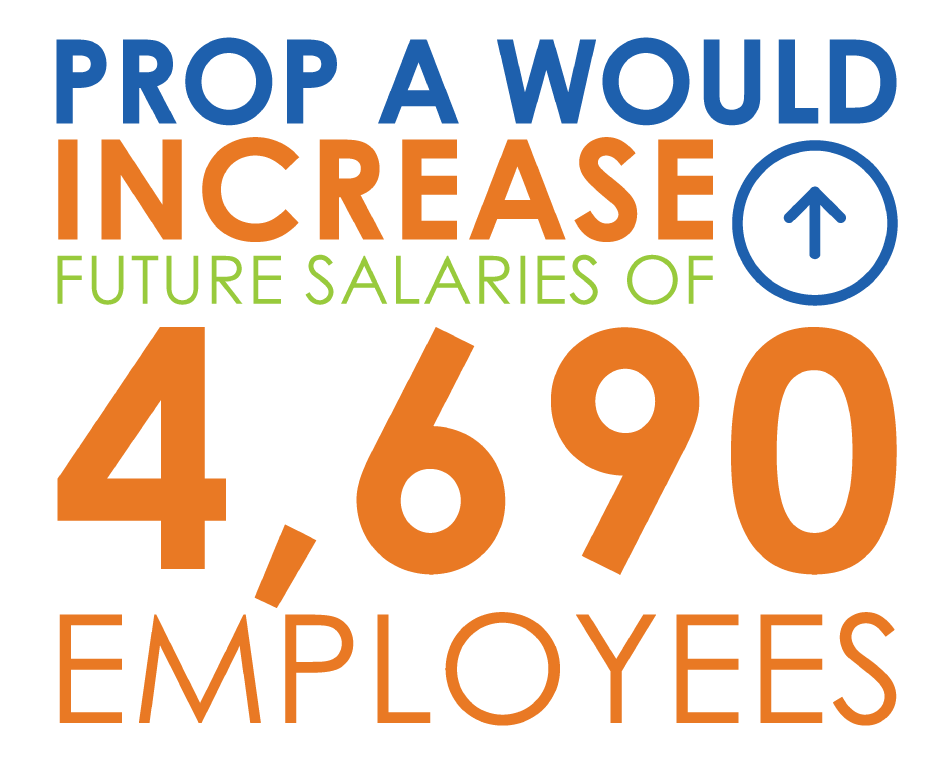

Teacher & Staff Support

Denton ISD is the second-largest employer in Denton County, and compensation plays a key role in attracting and retaining staff.

Proposition A provides funds to the district to continue to attract teachers to support student achievement and discipline in schools and address current class sizes.

-

Safety & Security

Texas House Bill 3 requires an armed officer on every campus. There is a shortage of School Safety Officers across the state. Every Denton ISD campus has a School Safety Officer (SSO) or Student Resource Officer (SRO).

Proposition A provides funds for competitive salaries and meets the requirements of HB3.

-

Student Programs & Enrichment

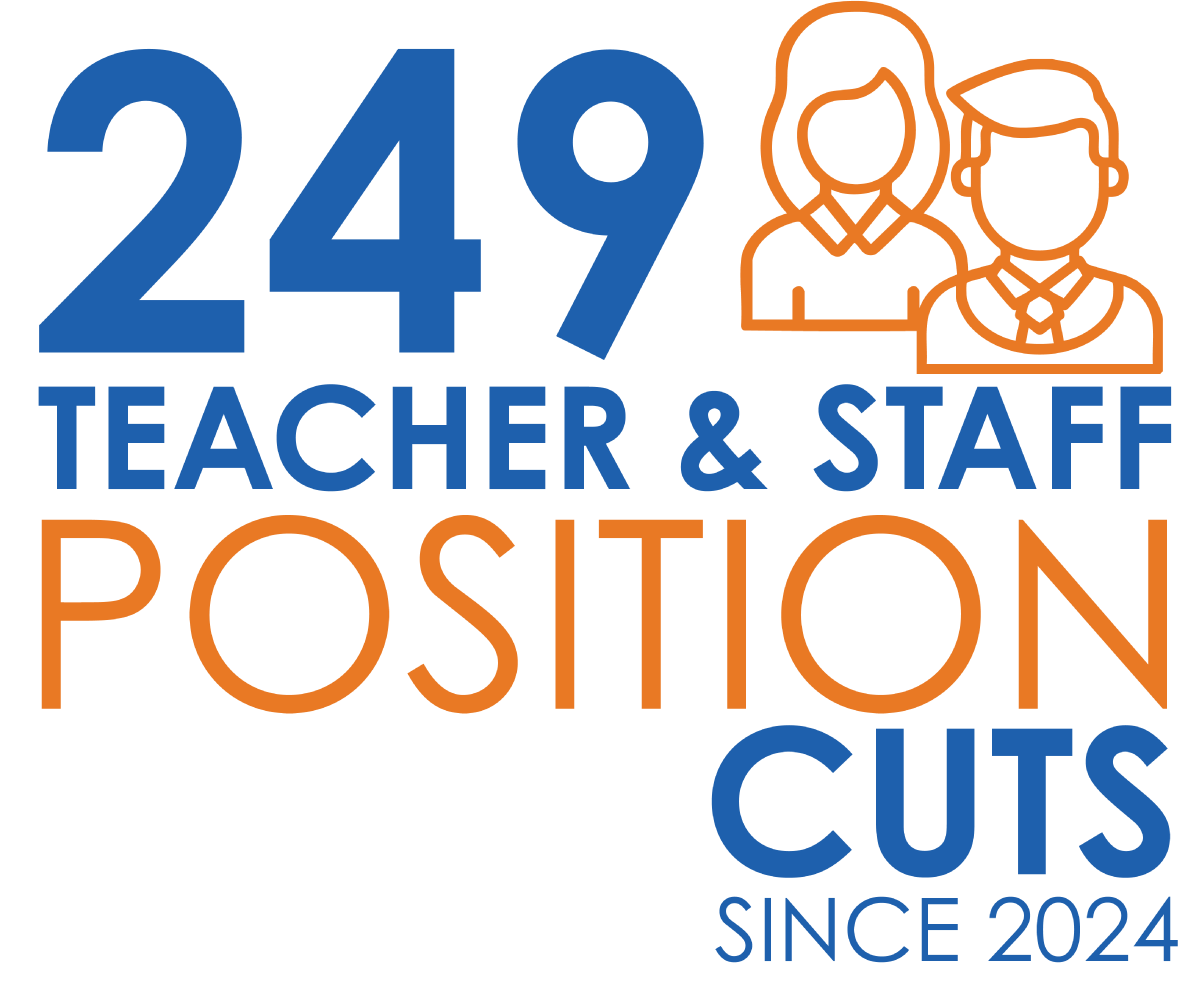

More than 250 positions were cut from the district through attrition and reduction in the last year. This includes positions such as reading recovery, interventionists, and bilingual support specialists.

Proposition A provides $5 million to support student programs and enrichment.